(The author is the Founder and CEO of Money Avenues, a Wealth Management firm based in Chennai. Feedback can be sent to mailfpc@ yahoo.com)

9-9-9 plan in Financial Planning can make you 99.9% sure...

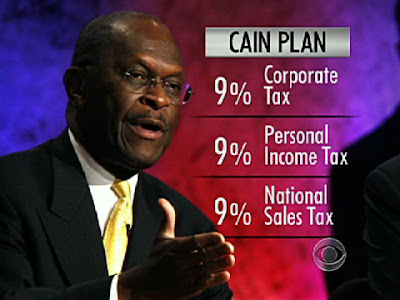

Herman Cain, the US presidential hopeful took America by storm with what he called as 9-9-9 tax plan for his citizens if he is elected the President. He kept it pretty simple, 9% flat tax for the corporates, individuals and sales. 9-9-9, as simple as that. Though the nation debated his plan quite extensively, he addressed the tax issue on a 'comman man's language.

Our personal financials are also quite simple and straight forward, if it is handled efficiently. Even if one considers it as complicated, its not rocket science for sure.

For our simple understanding of financial planning, let's adapt this Cain's 9-9-9 plan into our financial planning process and this, am sure can make you 99.9% sure on your financial security.

9 times of life insurance cover:

As a thumb role, one should have a life insurance cover of atleast 9 times of one's annual income. For eg., if one's annual income is Rs 10 lacs, the person should atleast a life insurance cover of 90 lacs, which means nine years of current income for the family as a security.

Remember, life insurance is a great tool to provide financial security to one and one's family in the times of crisis. As we all grow in our careers and lives with great ambitions, any unexpected break can jeopardize the journey. So have enough and ample life insurance cover equivalent of 9 times of your income.

9*2 % of annualized returns:

Soaring inflation, galloping cost of living, sky high dreams about future has made our financial life quite complicated. No longer can we be content with just 9% returns which we earn routinely. If the inflation is hovering around 12-13%, that means we must earn definitely more than that. We need to aspire for more to fund the inflation, cost of living, dreams and 9% is just not enough, but you should aim for 9*2% = 18% CAGR. So it's just not 9 but 9*2 if you want your life full of goals, dreams to reach their logical destination, be it children education, retirement plan etc.,

9 times of retirement fund:

Retirement is going to be a challenge for this generation. Shelf life of our jobs is shrinking with many of us aspiring to break away from the routine careers. With the advancement of medical sciences, we are going to live longer than the past. Which means when we retire let's assume @ 50 years and live till 80 years, we atleast need good amount of money to spend the next 30-35 years on our own without depending on our children. This demands a substantial retirement fund for our sustenance. Plan to have atleast 9 times of your income as your retirement fund taking the current income as a benchmark. For eg., if one's income is Rs 10 lacs, the plan should be made to generate a fund size of 90 lacs on a long term basis. As we grow up in salaries, the plan should also be modified accordingly.

9-9-9 financial plan is very simple and easy to follow, all one requires is to hire a good financial planner to make this successful. This will certainly lead to 99.9% success of your financial future which is nothing but 100% winning formula.

(The author is the Founder and CEO of Money Avenues, a Wealth Management firm based in Chennai. Feedback can be sent to mailfpc@ yahoo.com)

You have read this article with the title 9-9-9 plan in financial planning can make you 99.9% sure.... You can bookmark this page URL https://clapclapclappp.blogspot.com/2011/12/9-9-9-plan-in-financial-planning-can.html. Thanks!

No comment for "9-9-9 plan in financial planning can make you 99.9% sure..."

Post a Comment